Налогообложение Резидентов и Неризидентов в Казахстане

contents

Introduction

1 THEORETICAL ASPECTS OF FISCAL POLICY: TAXATION

1.1 Fiscal policy

1.2 Taxation

1.2.1 MAJOR TAXES and DUTIES

2 Features of Residents and Nonresidents taxation

2.1. Features of Resident

2.2 Permanent establishment of a nonresident

2.3 Nonresidents’ income from sources in the Republic of Kazakhstan

2.4 Procedure for the taxation of the income earned by nonresident legal entities doing business without creating a permanent establishment in the Republic of Kazakhstan

2.4.1 Procedure and deadlines for the payment of income tax at the source of payment

2.4.2 Provisions specific to the calculation and payment of income tax on

capital gains from the realization of securities

2.5 Procedure for the taxation of the income earned by nonresident legal entities doing business through a permanent establishment

2.5.1 Procedure for taxation of the net income of a nonresident legal entity from doing business through a permanent establishment

2.5.2 Procedure for taxation of the income of a nonresident legal entity in certain cases

2.6 Procedure for the taxation of the income of income of nonresident individual

2.6.1 Procedure for calculation and payment of the income tax on a nonresident individual whose activities lead to the creation of a permanent establishment

2.6.2 Procedure for the taxation of a nonresident individual’s income in certain cases

2.6.3 Procedure and deadlines for prepayment of the individual income tax

2.6.4 Statement of anticipated individual income tax and individual income tax return

2.7 Special provisions regarding international agreements

2.7.1 Proportional distribution of expenses method

2.7.2 Direct deduction of expenses method

2.7.3 Procedure for payment of the income tax on income earned by nonresidents from activity in the Republic of Kazakhstan not leading to the creation of a permanent establishment

2.7.4 Procedure for the application of an international agreement with respect to taxation of income from providing transportation services in international shipping

2.7.5 Procedure for the application of an international agreement with regard to the taxation of dividends, interest, and royalties

2.7.6 Procedure for the application of an international agreement with regard to the taxation of net income from doing business through a permanent establishment

2.7.7 Procedure for the application of an international agreement with regard to the taxation of other income from sources in the Republic of Kazakhstan

2.7.8 General requirements for the filing of a request to apply the provisions of an international agreement

Conclusion

Appendix A

Appendix B

THE LIST of USED SOURCES

Introduction

The taxes are a necessary part economic activity in a society from the moment of occurrence the states. Development and change of the forms of the state system always lead to transformation of tax system. Taxes – is basic sources of incomes of the state in a modern civilized society. Besides this especially financial function, taxes are used for economic influence of the state on public manufacture, its structure, and on condition of scientific and technical progress. Among economic levers, through which the state influences market economy, the important place belongs to the taxes. In conditions of market economy any state widely uses tax policy as the regulator of influence on the negative event in the market. The taxes, as well as all tax system, are the powerful tool of management of economy in terms of the market. The application of the taxes is one of economic methods of management and maintenance of interrelation of nation-wide interests with commercial interests of the businessmen and enterprises, independent from departmental subordination, patterns of ownership and legal form of the enterprise.

With the help of the taxes determined the mutual relation of the businessmen, enterprises of all forms is the properties with the state and local budgets, with banks, and also with higher-level organizations. Through the taxes the foreign trade activities are adjusted, include the attraction of the foreign investments.

The tax system in Kazakhstan is based on the Tax code enacted by the president’s Decree that has the force of Law on Taxes and other obligatory Payments to the Budget The taxes are the basic source of formation of a profitable part of the budget of Republic of Kazakhstan. Not last role in it plays the taxes from the nonresidents. According to the legislation on Kazakhstan foreign citizens - residents in the Republic of Kazakhstan (RK) are subject to individual income taxation on their worldwide income. Foreign citizens - nonresidents are subject to taxation only on income received from Kazakhstan sources. The following types of nonresidents’ income, among others, should be considered as received from sources in Kazakhstan:

· Income received from operations in the RK under individual labor agreements (contracts) or under other agreements of a civil-legal nature;

· Directors fees and /or other payments received by members of aboard of a resident legal entity, regardless of the place of the actual performance of their functions;

· Fringe benefits received in connection with their assignment to Kazakhstan its rates;

Payment and other conditions are regulated by the chapters 7, 10, 12, 15, 18 and other of Law on Taxes and other obligatory Payments to the Budget. Taxation of foreign citizens in the RK is also regulated by Conventions (agreements) on the avoidance of double taxation. In case there is a Tax Convention signed between Kazakhstan and the other foreign state, which may be applicable to a foreign employee, then the status of residency is determined in compliance with this Convention. The Tax Conventions do not regulate procedure of filing and regularity of tax payments. However, based on the status of residency of a foreign employee determined by the Tax Conventions specific reporting and taxation requirements stipulated by the Kazakhstan tax legislation should be fulfilled with respect to residents or nonresidents in the RK. In case the foreign employee is a resident of the other foreign state, then he/she should be considered as a nonresident for taxation purposes in Kazakhstan. In this case the foreign employee should file a Certificate on the Estimated Personal In-come Tax and pay personal income tax through the monthly transfer of advance payments. In case a foreign employee is considered as a resident of Kazakhstan, then the statutory rules do not contemplate filing of the Certificate on the Estimated Personal Income Tax and contemplate in-come tax payment once a year at the time of filing the income tax return from an individual for a year.

1. THEORETICAL ASPECTS OF FISCAL POLICY: TAXATION

1.1 Fiscal policy

Fiscal (lat. fiscalis - state) policy (politics) - is the aggregate of financial measures of the state on regulation of the governmental incomes and expenditures. It changes significant depending on put strategic tasks, as for example, anticrisis regulation, maintenance high employment, struggle with inflation.

The modern fiscal policy defines basic directions of use of financial resources of the state, means of financing and main sources of updating of treasury. Depending on concrete - historical conditions in different countries such policy (politics) has its own features. At the same time in Developed Countries is used set of common measures. It includes straight and indirect financial methods of regulation of economy.

To straight ways concern the means of budget regulation. By the means of the state budget are financed:

1) expense on expanding of reproduction;

2) unproductive expenditures of the state;

3) development of an infrastructure, scientific researches and etc.:

4) realization of structural policy (politics);

5) the support of military producers complex etc.

With help of indirect methods state influences on financial opportunity of the manufacturers of the goods and services and on the demand sizes of customer. The important role here plays the System Taxation. Changing the rates of the taxes on various kinds of the incomes, giving tax privileges, reducing free minimum of the incomes etc., state aspires to achieve probably steadier rates of economic Growth and to avoid sharp rises and falls of manufacture.

To number of the important indirect methods assisting accumulation of the capital, is the policy (politics) of the accelerated amortization. On the essence, the state exempts the businessmen from payment taxes with part of the profit, is artificial redistribute it in amortization fund. So, in Germany in the beginning 70 years on a number of industries on amortization it was authorized to write off till 20-30 of % of cost of a fixed capital in one year. In Great Britain in first year of introduction in using of the new equipment it was possible to deduct in fund of amortization 50 % of cost new instruments of manufacture.

However in these cases the amortization is written off in the sizes, that significant exceeding the valid deterioration basic capital, in consequences the raise of price on made with the help of this equipment production. If accelerated amortization expands financial opportunities of the businessmen, simultaneously it deteriorates the condition of realization of production and reduces purchasing power of population.

Depending on character of use direct and indirect financial methods distinguish two kinds of fiscal policy of the state:

a) Discretion

b) Non-discretion.

a) Discretion (lat. discrecio - working on itself discretion) the policy (politics) means the following. The state consciously regulates its expenditure and taxation with the purposes of improvements economic of situation of the country. At the same time government takes into account the following checked up on practice functional dependences between financial variable.

The first dependence: the growth of the state expenditures increases cumulative demand (consumption and investments). Thereof increase output and employment of the population. Is important to take into account, that state expenditures influence on cumulative demand the same as to investments (work as the animator of investment which has developed J. Keynes). The animator state expenditures MG shows, how much grows total national product D GNP in result of increase of these expenditures DG:

D GNP =DG ' MG

It is natural, that at reduction of state expenses G reduces the volume of GNP.

Other functional dependence shows, that increase the sums of the taxes are reduced the personal available income of household. In this case are reduced demand and volume of production and employment of a labor. And on the contrary: decrease (reduction) of the taxes conducts to increase of the consumer expenditures, production and employment.

The change of the taxation gives multiply effect. However the multiplier of the taxes is less than the multiplier of the investments and state expenditures. Actually increase in unit of a gain of the investments (and state expenditures) is directly influenced on increase in the volume of the GNP. At reduction of taxes, grows available income, however part it goes on the consumption, and stayed share is spent for the savings.

Mentioned functional dependences are used in discretion policy (politics) of the state for influence on business cycle. Certainly, this policy (politics) differs on different phases of a cycle.

For example, at crisis the policy (politics) of economic growth will be carried out.

In interests of growth GNP the state expenditures are increased, the taxes are reduced, and the growth of the expenditures is combined with reduction the taxes so that multiply effect on state expenses was more than multiply effect of the taxes. A result is reduction of recession of manufacture.

When there is an inflationary growth of manufacture (rise, induced by surplus of demand), the government will carry out policy (politics) that hold back business activity - reduces the state expenditures, increases the taxes. These measures are combined so that multiply effect of reduction of the expenditures was more, than multiplier of growth of the taxes. In result the cumulative demand is reduced and volume GNP accordingly decreases.

b) The second kind of fiscal policy - non-discretion, or policy of the automatic (built - in) stabilizers. The automatic stabilizer - economic mechanism, which without assistance of the state eliminates an adverse situation on different phases business cycle. Basic built - in stabilizers are tax receipt and social payments that are carried out by the state.

On a phase of rise, naturally, the incomes of firms and population grow. But at the progressive taxation the sums of the taxes increased even faster. In this period the unemployment is reduced, well being of needy families is improved. Hence, decrease the payments of the unemployment benefits and others social expenditures of the state. In a result the cumulative demand is reduced, and it constrains economic growth.)

The tendency of transfer payment spending to rise during recessions and fall during expansions results from the bases on which people qualify to receive these payments. People qualify to receive welfare programs only if their income falls below a certain level. They qualify for unemployment compensation by losing their jobs. When the economy expands, incomes and employment rise, and fewer people qualify for welfare or unemployment benefits. Spending for those programs therefore tends to fall. When economic activity falls, incomes fall. people lose jobs, and more people qualify for aid, so spending for these programs rises.

Taxes affect the relationship between real GDP and personal disposable income they therefore affect consumption expenditures. They also influence investment decisions. Taxes imposed on firms affect the profitability of investment decisions and therefore affect the levels of investment firms will choose. Payroll taxes imposed on firms affect the costs of hiring workers; they therefore have -impact on employment and on the real wages earned by workers.

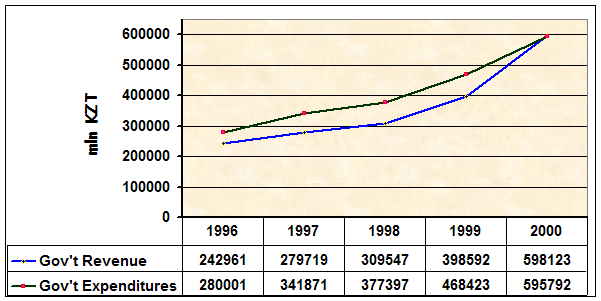

Exhibit below compares government revenues to government expenditures since I996. We see that government spending in Kazakhstan has systematically exceeded revenues, revealing an underlying fiscal deficit between 4 percent and almost 9 percent of GDP, entailing substantial public sector borrowing requirements. Until 1994, fiscal deficit had essentially financed through monetary expansion by the Central bank, with a highly detrimental effect on the rate of inflation during the period. Since then, the National Bank of Kazakhstan has adopted a more independent monetary policy, and fiscal deficits have basically financed either by the proceeds from privatization of state assets or by borrowing foreign loans.

Sources: Statistics Agency of RK, 2001

On a phase of crisis tax receipts automatically fall and reduced the sum of withdrawals from the incomes of firms and households. Simultaneously grow payments of social character, including unemployment benefit.

At result the purchasing power of the population is increased, that helps to overcoming recession of economy.

From mentioned above it is visible, how large place occupies taxation in financial regulation of macroeconomic. So we can conclude that the main direction of fiscal policy of the state is improving the legislations and practice collection of tax.

Let's take example for the most important version of the taxes – the income tax, which is established on the incomes of physical persons and on profit of firms. How the size of this tax is defined (determined)?

First is counted the total income - sum of all incomes that are getting by the physical and legal entities from different sources. From the total income by the legislation it is usual it is authorized deduct: 1) industrial, transport, the travelers and advertising expenditures; 2) various tax privileges (free minimum of the incomes; for example, in USA in 1990 this minimum was 2050 dollars; the sums of the donations, privilege for the pensioners, disable people etc.). Thus, taxed income is a difference between the total income and the specified deductions.

It is important to establish optimum tax rate (size of the tax on unit of taxation). The following rates of the tax differ:

· hard, which are established on unit of object independently on its cost (for example, motor vehicle);

· proportional, i.e. uniform percent(interest) of payment of the taxes independently on the sizes of the incomes;

· progressive, growing with increase of the incomes.

The practice shows, that at the extremely high rates of taxes discourages to work and to the innovation. Sharp increase in 60-70-е years in western countries of tax burden has resulted the negative consequences. It has caused " Tax revolts ", wide evasion from the taxes, promoted outflow of the capitals and flight of the addressees of the high personal incomes in the countries with one lower level of the taxation.

As it is known, in 70’s neo-conservators have put forward the theory of Supply. Its authors have established, that growth of the taxation renders adverse influence on dynamics of manufacture and incomes. Increase of the taxes at the expense of increase of their rates on certain stage does not compensate reduction of receipts in the state budget because of fast narrowing taxed incomes, and then it can be accompanied also by reduction of total sums of the budget incomes. In a result the high taxes render constraining influence on the offer of the capital, work and savings.

Basic task of economic policy representatives of the theory of Supply consider determining the optimum rates of taxation and both tax privileges and payments. Decrease (reduction) of the taxes is considered as a means capable to ensure Long-term economic growth and struggle with inflation. It will strengthen aspiration to receive huge incomes, will render the stimulating influence will increase by growth of production.

1.2 Taxation

As required by the Constitution of Kazakhstan, within the tax system of Kazakhstan, any taxes, levies, and other obligatory payments may be established only by the laws enacted by the Parliament of the Republic of Kazakhstan. Parliament may not delegate its constitutional powers to establish the tax system, taxes or levies, and sanctions for tax violations to the government or any other authority. Under the Constitution, laws in general and tax laws in particular enter into effect after the President signs them.

Tax legislation of the Republic of Kazakhstan consists of the Tax Code and Normative Legal Acts, and is regulated by International Agreements. Tax legislation is based on the principles of the mandatory nature of payment of taxes and other mandatory payments to revenue, certainty and equity of taxation, unity of the tax system and publicity of tax legislation. The Tax Code of the Republic of Kazakhstan establishes Kazakhstan taxes, levies, and general tax principles. A tax takes largest share of budget revenues (Appendix A).

Companies formed in Kazakhstan under Kazakhstan law are taxed on world-wide income. Income earned by a foreign company or person through a permanent establishment in Kazakhstan is taxed in Kazakhstan. Branches of foreign entities are taxed on Kazakhstan source income (where services are performed, not where paid for). Income from a Kazakhstan source to a non-resident and not related to a permanent establishment, is taxed at the source of the payment, and further, on the total income without deductions, excluding labor that is taxed as personal income.

Double Tax Treaties In December 1996, a treaty on the Avoidance of Double Taxation between the United States and Kazakhstan came into force. A number of treaties on the avoidance of double taxation were ratified in 1998. This includes agreements with the following countries: the Czech Republic (November 1998), France (November 1998), Sweden (July 1998), Bulgaria (July 1998), Turkmenistan (July 1998), Georgia (July 1998), Republic of Korea (July 1998), Germany (November 1998), and Belgium (November 1998).

Kazakhstan has double tax treaties with more than 20 countries, which generally follow the OECD Model Income Tax Convention.

referat-web.com Бесплатно скачать - рефераты, курсовые, контрольные. Большая база работ.

referat-web.com Бесплатно скачать - рефераты, курсовые, контрольные. Большая база работ.