Sports in the USA

SouthUral State University

The Department of Economic and Management

Work on subject

The Student: Velichko O.S.

The Student: Velichko O.S.

Group: E&M-263

The Tutor: Sergeeva L.M.

Chelyabinsk

1998

Contents

1. Market place

2. Trading on the stock exchange floor

3. Securities. Categories of common stock

3.1 Growth stocks

3.2 Cyclical stocks

3.3 Special situations

4. Preferred stocks

4.1 Bonds-corporate

4.2 Bonds-U.S. government

4.3 Bonds-municipal

4.4 Convertible securities

4.5 Option

4.6 Rights

4.7 Warrants

4.8 Commodities and financial futures

5. Stock market averages reading the newspaper quotations

5.1 The price-earnings ratio

6. European stock markets–general trend

6.1 New ways for old

6.2 Europe, meet electronics

7. New issues

8. Mutual funds. A different approach

8.1 Advantages of mutual funds

8.2 Load vs. No-load

8.3 Common stock funds

8.4 Other types of mutual funds

8.5 The daily mutual fund prices

8.6 Choosing a mutual fund

1. MARKET PLACE

The stock market. To some it’s a puzzle. To others it’s a source of profit and endless fascination. The stock market is the financial nerve center of any country. It reflects any change in the economy. It is sensitive to interest rates, inflation and political events. In a very real sense, it has its fingers on the pulse of the entire world.

Taken in its broadest sense, the stock market is also a control center. It is the market place where businesses and governments come to raise money so that they can continue and expend their operations. It is the market place where giant businesses and institutions come to make and change their financial commitments. The stock market is also a place of individual opportunity.

The phrase “the stock market” means many things. In the narrowest sense, a stock market is a place where stocks are traded – that is bought and sold. The phrase “the stock market” is often used to refer to the biggest and most important stock market in the world, the New York Stock Exchange, which is as well the oldest in the US. It was founded in 1792. NYSE is located at 11 Wall Street in New York City. It is also known as the Big Board and the Exchange. In the mid-1980s NYSE-listed shares made up approximately 60% of the total shares traded on organized national exchanges in the United States.

AMEX stands for the American Stock Exchange. It has the second biggest volume of trading in the US. Located at 86 Trinity Place in downtown Manhattan, the AMEX was known until 1921 as the Curb Exchange, and it is still referred to as the Curb today. Early traders gathered near Wall Street. Nothing could stop those outdoor brokers. Even in the snow and rain they put up lists of stocks for sale. The gathering place became known as the outdoor curb market, hence the name the Curb. In 1921 the Curb finally moved indoors. For the most part, the stocks and bonds traded on the AMEX are those of small to medium-size companies, as contrasted with the huge companies whose shares are traded on the New York Stock Exchange.

The Exchange is non-for-profit corporation run by a board of directors. Its member firm are subject to a strict and detailed self-regulatory code. Self-regulation is a matter of self-interest for stock exchange members. It has built public confidence in the Exchange. It also required by law. The US Securities and Exchange Commission (SEC) administers the federal securities laws and supervises all securities exchange in the country. Whenever self-regulation doesn’t do the job, the SEC is likely to step in directly. The Exchange doesn’t buy, sell or own any securities nor does it set stock prices. The Exchange merely is the market place where the public, acting through member brokers, can buy and sell at prices set by supply and demand.

It costs money it become an Exchange member. There are about 650 memberships or “seats” on the NYSE, owned by large and small firms and in some cases by individuals. These seats can be bought and sold; in 1986 the price of a seat averaged around $600,000. Before you are permitted to buy a seat you must pass a test that strictly scrutinizes your knowledge of the securities industry as well as a check of experience and character.

Apart from the NYSE and the AMEX there are also “regional” exchange in the US, of which the best known are the Pacific, Midwest, Boston and Philadelphia exchange.

There is one more market place in which the volume of common stock trading begins to approach that of the NYSE. It is trading of common stock “over-the-counter” or “OTC”–that is not on any organized exchange. Most securities other than common stocks are traded over-the-counter. For example, the vast market in US Government securities is an over-the-counter market. So is the money market–the market in which all sorts of short-term debt obligations are traded daily in tremendous quantities. Like-wise the market for long-and short-term borrowing by state and local governments. And the bulk of trading in corporate bonds also is accomplished over-the-counter.

While most of the common stocks traded over-the-counter are those of smaller companies, many sizable corporations continue to be found on the “OTC” list, including a large number of banks and insurance companies.

As there is no physical trading floor, over-the-counter trading is accomplished through vast telephone and other electronic networks that link traders as closely as if they were seated in the same room. With the help of computers, price quotations from dealers in Seattle, San Diego, Atlanta and Philadelphia can be flashed on a single screen. Dedicated telephone lines link the more active traders. Confirmations are delivered electronically rather than through the mail. Dealers thousands of miles apart who are complete strangers execute trades in the thousands or even millions of dollars based on thirty seconds of telephone conversation and the knowledge that each is a securities dealer registered with the National Association of Securities Dealers (NASD), the industry self-regulatory organization that supervises OTC trading. No matter which way market prices move subsequently, each knows that the trade will be honoured.

2. TRADING ON THE STOCK EXCHANGE FLOOR

When an individual wants to place an order to buy or sell shares, he contacts a brokerage firm that is a member of the Exchange. A registered representative or “RR” will take his order. He or she is a trained professional who has passed an examination on many matters including Exchange rules and producers.

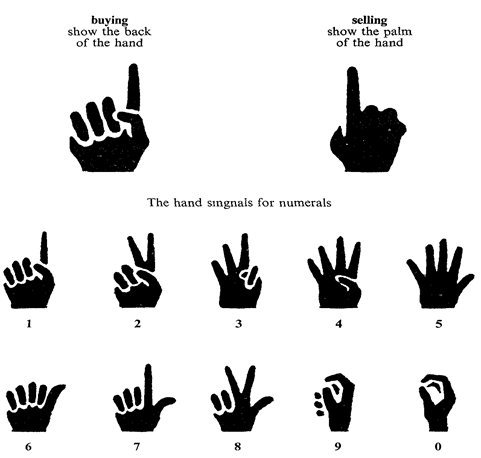

The individual’s order is relayed to a telephone clerk on the floor of the Exchange and by the telephone clerk to the floor broker. The floor broker who actually executes the order on the trading floor has an exhausting and high-pressure job. The trading floor is a larger than half the size of football field. It is dotted with multiple locations called “trading posts”. The floor broker proceeds to the post where this or that particular stock is traded and finds out which other brokers have orders from clients to buy or sell the stock, and at what prices. If the order the individual placed is a “market order”–which means an order to buy or sell without delay at the best price available–the broker size up the market, decides whether to bargain for a better price or to accept one of the orders being shown, and executes the trade–all this happens in a matter of seconds. Usually shares are traded in round lots on securities exchanges. A round lot is generally 100 shares, called a unit of trading, anything less is called an odd lot.

When you first see the trading floor, you might assume all brokers are the same, but they aren’t. There are five categories of market professionals active on the trading floor.

Commission Brokers, usually floor brokers, work for member firms. They use their experience, judgment and execution skill to buy and sell for the firm’s customer for a commission.

Independent Floor Brokers are individual entrepreneurs who act for a variety of clients. They execute orders for other floor brokers who have more volume than they can handle, or for firms whose exchange members are not on the floor.

Registered Competitive Market Makers have specific obligations to trade for their own or their firm’s accounts–when called upon by an Exchange official–by making a bid or offer that will narrow the existing quote spread or improve the depth of an existing quote.

Competitive Traders trade for their own accounts, under strict rules designed to assure that their activities contribute to market liquidity.

And last, but not least, come Stock Specialists. The Exchange tries to preserve price continuity– which means that if a stock has been trading at, say, 35, the next buyer or seller should be able to an order within a fraction of that price. But what if a buyer comes in when no other broker wants to sell close to the last price? Or vice versa for a seller? How is price continuity preserved? At this point enters the Specialist. The specialist is charged with a special function, that of maintaining continuity in the price of specific stocks. The specialist does this by standing ready to buy shares at a price reasonably close to the last recorded sale price when someone wants to sell and there is a lack of buyers, and to sell when there is a lack of sellers and someone wants to buy. For each listed stock, there are one or more specialist firms assigned to perform this stabilizing function. The specialist also acts as a broker, executing public orders for the stock, and keeping a record of limit orders to be executed if the price of the stock reaches a specified level. Some of the specialist firms are large and assigned to many different stocks. The Exchange and the SEC are particularly interested in the specialist function, and trading by the specialists is closely monitored to make sure that they are giving precedence to public orders and helping to stabilize the markets, not merely trying to make profits for themselves. Since a specialist may at any time be called on to buy and hold substantial amounts of stock, the specialist firms must be well capitalized.

In today's markets, where multi-million-dollar trades by institutions (i. e. banks, pension funds, mutual funds, etc.) have become common, the specialist can no longer absorb all of the large blocks of stock offered for sale, nor supply the large blocks being sought by institutional buyers. Over the last several years, there has been a rapid growth in block trading by large brokerage firms and other firms in the securities industry. If an institution wants to sell a large block of stock, these firms will conduct an expert and rapid search for possible buyers; if not enough buying interest is found, the block trading firm will fill the gap by buying shares itself, taking the risk of owning the shares and being able to dispose of them subsequently at a profit. If the institution wants to buy rather than sell, the process is reversed. In a sense, these firms are fulfilling the same function as the specialist, but on a much larger scale. They are stepping in to buy and own stock temporarily when offerings exceed demand, and vice versa.

So the specialists and the block traders perform similar stabilizing functions, though the block traders have no official role and have no motive other than to make a profit.

3. SECURITIES. CATEGORIES OF COMMON STOCK

There is a lot to be said about securities. Security is an instrument that signifies (1) an ownership position in a corporation (a stock), (2) a creditor relationship with a corporation or governmental body (a bond), or (3) rights to ownership such as those represented by an option, subsription right, and subsription warrant.

People who own stocks and bonds are referred to as investors or, respectively, stockholders (shareholders) and bondholders. In other words a share of stock is a share of a business. When you hold a stock in a corporation you are part owner of the corporation. As a proof of ownership you may ask for a certificate with your name and the number of shares you hold. By law, no one under 21 can buy or sell stock. But minors can own stock if kept in trust for them by an adult. A bond represents a promise by the company or government to pay back a loan plus a certain amount of interest over a definite period of time.

We have said that common stocks are shares of ownership in corporations. A corporation is a separate legal entity that is responsible for its own debts and obligations. The individual owners of the corporation are not liable for the corporation's obligations. This concept, known as limited liability, has made possible the growth of giant corporations. It has allowed millions of stockholders to feel secure in their position as corporate owners. All that they have risked is what they paid for their shares.

A stockholder (owner) of a corporation has certain basic rights in proportion to the number of shares he or she owns. A stockholder has the right to vote for the election of directors, who control the company and appoint management. If the company makes profits and the directors decide to pay part of these profits to shareholders as dividends, a stockholder has a right to receive his proportionate share. And if the corporation is sold or liquidates, he has a right to his proportionate share of the proceeds.

What type of stocks can be found on stock exchanges? The question can be answered in different ways. One way is by industry groupings. There are companies in every industry, from aerospace to wholesale distributers. The oil and gas companies, telephone companies, computer companies, autocompanies and electric utilities are among the biggest groupings in terms of total earnings and market value. Perhaps a more useful way to distinguish stocks is according to the qualities and values investors want.

3.1 Growth Stocks.

The phrase "growth stock" is widely used as a term to describe what many investors are looking for. People who are willing to take greater-than-average risks often invest in what is often called "high-growth" stocks—stocks of companies that are clearly growing much faster than average and where the stock commands a premium price in the market. The rationale is that the company's earnings will continue to grow rapidly for at least a few more years to a level that justifies the premium price. An investor should keep in mind that only a small minority of companies really succeed in making earnings grow rapidly and consistently over any long period. The potential rewards are high, but the stocks can drop in price at incredible rates when earnings don't grow as expected. For example, the companies in the video game industry boomed in the early 1980s, when it appeared that the whole world was about to turn into one vast video arcade. But when public interest shifted to personal computers, the companies found themselves stuck with hundreds of millions of dollars in video game inventories, and the stock collapsed.

There is less glamour, but also less risk, in what we will call—for lack of a better phrase—"moderate-growth" stocks. Typically, these might be stocks that do not sell at premium, but where it appears that the company's earnings will grow at a faster-than-average rate for its industry. The trick, of course, is in forecasting which companies really will show better-than-average growth; but even if the forecast is wrong, the risk should not be great, assuming that the price was fair to begin with.

There's a broad category of stocks that has no particular name but that is attractive to many investors, especially those who prefer to stay on the conservative side. These are stocks of companies that are not glamorous, but that grow in line with the economy. Some examples are food companies, beverage companies, paper and packaging manufacturers, retail stores, and many companies in assorted consumer fields.

As long as the economy is healthy and growing, these companies are perfectly reasonable investments; and at certain times when everyone is interested in "glamour" stocks, these "non-glamour" issues may be neglected and available at bargain prices. Their growth may not be rapid, but it usually is reasonably consistent. Also, since these companies generally do not need to plow all their earnings back into the business, they tend to pay sizable dividends to their stockholders. In addition to the real growth that these companies achieve, their values should adjust upward over time in line with inflation—a general advantage of common stocks that is worth repeating.

3.2 Cyclical Stocks.

These are stocks of companies that do not show any clear growth trend, but where the stocks fluctuate in line with the business cycle (prosperity and recession) or some other recognizable pattern. Obviously, one can make money if he buys these near the bottom of a price cycle and sells near the top. But the bottoms and tops can be hard to recognize when they occur; and sometimes, when you think that a stock is near the bottom of a cycle, it may instead be in a process of long-term decline.

3.3 Special Situations.

There’s a type of investment that professionals usually refer to as “special situations”. These are cases where some particular corporate development–perhaps a merger, change of control, sale of property, etc.– seems likely to raise the value of a stock. Special situation investments may be less affected by general stock market movements than the average stock investment; but if the expected development doesn’t occur, an investor may suffer a loss, sometimes sizable. Here the investor has to judge the odds of the expected development’s actually coming to pass.

4. PREFERRED STOCKS

A preferred stock is a stock which bears some resemblances to a bond (see below). A preferred stockholder is entitled to dividends at a specified rate, and these dividends must be paid before any dividends can be paid on the company's common stock. In most cases the preferred dividend is cumulative, which means that if it isn't paid in a given year, it is owed by the company to the preferred stockholder. If the corporation is sold or liquidates, the preferred stockholders have a claim on a certain portion of the assets ahead of the common stockholders. But while a bond is scheduled to be redeemed by the corporation on a certain "maturity" date, a preferred stock is ordinarily a permanent part of the corporation's capital structure. In exchange for receiving an assured dividend, the preferred stockholder generally does not share in the progress of the company; the preferred stock is only entitled to the fixed dividend and no more (except in a small minority of cases where the preferred stock is "participating" and receives higher dividends on some basis as the company's earnings grow).

Many preferred stocks are listed for trading on the NYSE and other exchanges, but they are usually not priced very attractively for individual buyers. The reason is that for corporations desiring to invest for fixed income, preferred stocks carry a tax advantage over bonds. As a result, such corporations generally bid the prices of preferred stocks up above the price that would have to be paid for a bond providing the same income. For the individual buyer, a bond may often be a better buy.

4.1 Bonds-Corporate

Unlike a stock, a bond is evidence not of ownership, but of a loan to a company (or to a government, or to some other organization). It is a debt obligation. When you buy a corporate bond, you have bought a portion of a large loan, and your rights are those of a lender. You are entitled to interest payments at a specified rate, and to repayment of the full "face amount" of the bond on a specified date. The fixed interest payments are usually made semiannually. The quality of a corporate bond depends on the financial strength of the issuing corporation.

Bonds are usually issued in units of $1,000 or $5,000, but bond prices are quoted on the basis of 100 as "par" value. A bond price of 96 means that a bond of $1,000 face value is actually selling at $960 And so on.

Many corporate bonds are traded on the NYSE, and newspapers carry a separate daily table showing bond trading. The major trading in corporate bonds, however, takes place in large blocks of $100,000 or more traded off the Exchange by brokers and dealers acting for their own account or for institutions.

4.2 Bonds-U. S. Government

U.S. Treasury bonds (long-term), notes (intermediate-term) and bills (short-term), as well as obligations of the various U. S. government agencies, are traded away from the exchanges in a vast professional market where the basic unit of trading is often $ 1 million face value in amount. However, trades are also done in smaller amounts, and you can buy Treasuries in lots of $5,000 or $10,000 through a regular broker. U. S. government bonds are regarded as providing investors with the ultimate in safety.

4.3 Bonds-Municipal

Bonds issued by state and local governments and governmental units are generally referred to as "municipals" or "tax-exempts", since the income from these bonds is largely exempt from federal income tax.

Tax-exempt bonds are attractive to individuals in higher tax brackets and to certain institutions. There are many different issues and the newspapers generally list only a small number of actively traded municipals. The trading takes place in a vast, specialized over-the-counter market. As an offset to the tax advantage, interest rates on these bonds are generally lower than on U. S. government or corporate bonds. Quality is usually high, but there are variations according to the financial soundness of the various states and communities.

4.4 Convertible Securities

A convertible bond (or convertible debenture) is a corporate bond that can be converted into the company's common stock under certain terms. Convertible preferred stock carries a similar "conversion privilege". These securities are intended to combine the reduced risk of a bond or preferred stock with the advantage of conversion to common stock if the company is successful. The market price of a convertible security generally represents a combination of a pure bond price (or a pure preferred stock price) plus a premium for the conversion privilege. Many convertible issues are listed on the NYSE and other exchanges, and many others are traded over-the-counter

4.5 Options

An option is a piece of paper that gives you the right to buy or sell a given security at a specified price for a specified period of time. A "call" is an option to buy, a "put" is an option to sell. In simplest form, these have become an extremely popular way to speculate on the expectation that the price of a stock will go up or down. In recent years a new type of option has become extremely popular: options related to the various stock market averages, which let you speculate on the direction of the whole market rather than on individual stocks. Many trading techniques used by expert investors are built around options; some of these techniques are intended to reduce risks rather than for speculation.

4.6 Rights

When a corporation wants to sell new securities to raise additional capital, it often gives its stockholders rights to buy the new securities (most often additional shares of stock) at an attractive price. The right is in the nature of an option to buy, with a very short life. The holder can use ("exercise") the right or can sell it to someone else. When rights are issued, they are usually traded (for the short period until they expire) on the same exchange as the stock or other security to which they apply.

4.7 Warrants

A warrant resembles a right in that it is issued by a company and gives the holder the option of buying the stock (or other security) of the company from the company itself for a specified price. But a warrant has a longer life—often several years, sometimes without limit As with rights, warrants are negotiable (meaning that they can be sold by the owner to someone else), and several warrants are traded on the major exchanges.

4.8 Commodities and Financial Futures

The commodity markets, where foodstuffs and industrial commodities are traded in vast quantities, are outside the scope of this text. But because the commodity markets deal in "futures"—that is, contracts for delivery of a certain good at a specified future date— they have also become the center of trading for "financial futures", which, by any logical definition, are not commodities at all.

Financial futures are relatively new, but they have rapidly zoomed in importance and in trading activity. Like options, the futures can be used for protective purposes as well as for speculation. Making the most headlines have been stock index futures, which permit investors to speculate on the future direction of the stock market averages. Two other types of financial futures are also of great importance: interest rate futures, which are based primarily on the prices of U.S. Treasury bonds, notes, and bills, and which fluctuate according to the level of interest rates; and foreign currency futures, which are based on the exchange rates between foreign currencies and the U.S. dollar. Although, futures can be used for protective purposes, they are generally a highly speculative area intended for professionals and other expert investors.

5. STOCK MARKET AVERAGES READING THE NEWSPAPER QUOTATIONS

The financial pages of the newspaper are mystery to many people. But dramatic movements in the stock market often make the front page. In newspaper headlines, TV news summaries, and elsewhere, almost everyone has been exposed to the stock market averages.

In a brokerage firm office, it’s common to hear the question “How’s the market?” and answer, “Up five dollars”, or “Down a dollar”. With 1500 common stocks listed on the NYSE, there has to be some easy way to express the price trend of the day. Market averages are a way of summarizing that information.

Despite all competition, the popularity crown still does to an average that has some of the qualities of an antique–the Dow Jones Industrial Average, an average of 30 prominent stocks dating back to the 1890s. This average is named for Charles Dow–one of the earliest stock market theorists, and a founder of Dow Jones & Company, a leading financial news service and publisher of the Wall Street Journal.

In the days before computers, an average of 30 stocks was perhaps as much as anyone could calculate on a practical basis at intervals throughout the day. Now, the Standard & Poor’s 500 Stock Index (500 leading stocks) and the New York Stock Exchange Composite Index (all stocks on the NYSE) provide a much more accurate picture of the total market. The professionals are likely to focus their attention on these “broad” market indexes. But old habits die slowly, and someone calls out, “How’s the market?” and someone else answers, “Up five dollars,” or “Up five”–it’s still the Dow Jones Industrial Average (the “Dow” for short) that they’re talking about.

The importance of daily changes in the averages will be clear if you view them in percentage terms. When the market is not changing rapidly, the normal daily change is less than ½ of 1%. A change of ½% is still moderate; 1% is large but not extraordinary; 2% is dramatic. From the market averages, it’s a short step to the thousands of detailed listings of stock prices and related data that you’ll find in the daily newspaper financial tables. These tables include complete reports on the previous day’s trading on the NYSE and other leading exchanges. They can also give you a surprising amount of extra information.

Some newspapers provide more extensive tables, some less. Since the WallStreet Journal is available world wide, we’ll use it as a source of convenient examples. You’ll find a prominent page headed “New York Stock Exchange Composite Transactions”. This table covers the day’s trading for all stocks listed on the NYSE. “Composite” means that it also includes trades in those same stocks on certain other exchanges (Pacific, Midwest, etc.) where the stocks are “dually listed”. Here are some sample entries:

| 52 Weeks | Yld | P-E | Sales | Net | ||||||

| High | Low | Stock | Div | % | Ratio | 100s | High | Low | Close | Chg. |

52 7/8 | 37 5/8 | Cons Ed | 2.68 | 5.4 | 12 | 909 | 49 3/8 | 48 7/8 | 49 1/4 | +1/4 |

91 1/8 | 66 1/2 | Gen El | 2.52 | 2.8 | 17 | 11924 | 91 3/8 | 89 5/8 | 90 | -1 |

41 3/8 | 26 1/4 | Mobil | 2.20 | 5.4 | 10 | 15713 | 41 | 40 1/2 | 40 7/8 | +5/8 |

Категории:

- Астрономии

- Банковскому делу

- ОБЖ

- Биологии

- Бухучету и аудиту

- Военному делу

- Географии

- Праву

- Гражданскому праву

- Иностранным языкам

- Истории

- Коммуникации и связи

- Информатике

- Культурологии

- Литературе

- Маркетингу

- Математике

- Медицине

- Международным отношениям

- Менеджменту

- Педагогике

- Политологии

- Психологии

- Радиоэлектронике

- Религии и мифологии

- Сельскому хозяйству

- Социологии

- Строительству

- Технике

- Транспорту

- Туризму

- Физике

- Физкультуре

- Философии

- Химии

- Экологии

- Экономике

- Кулинарии

Подобное:

- Survival of the Welsh Language

- The 70-th anniversary

Our teachers and students have prepared for their 70-th anniversary for more than a year. During the last few years all meetings and arrangements at the Technical School were devoted to this date. Administrative teaching staff and the Methodical Coun

- The Church of England

МЕЖДУНАРОДНЫЙ НЕЗАВИСИМЫЙЭКОЛОГО-ПОЛИТОЛОГИЧЕСКИЙУНИВЕРСИТЕТРеферат по страноведению на тему: «The Church of England»Москва, 2002The Church of EnglandConten

- The History of English

- The House of Yorks

Izmail State Liberal Arts UniversityUkrainian ministry of Higher education The chair of English PhilologyReportThe House of York Written by2nd year studentEnglish-German departmentOf Faculty of Foreighn LanguahesElena BlindirovaIzmail, 2004House o

- The New-York City, Places of interest

IntroductionI have been learning English for a long time. Learning foreign languages is simply impossible without knowing the history, the places of interest the country the language of which you learn. The big City with its skyscrapers seems to be

- The USA: its history, geography and political system

Contents:A brief history of the USAThe colonial era1A new nation2Slavery and The Civil War2The late 19th century3The progressive moment4War and peace4The great depression5World War II5The Cold War6Decades of change7Geography and regional characterist

Copyright © https://www.referat-web.com/. All Rights Reserved

referat-web.com Бесплатно скачать - рефераты, курсовые, контрольные. Большая база работ.

referat-web.com Бесплатно скачать - рефераты, курсовые, контрольные. Большая база работ.